Please consider the environment before printing

CCCA | Mondaq

2023 Canadian In-House Counsel Report

Unparalleled Insights into Canada's In-House Profession from CCCA | Mondaq

Sponsored by

INTRODUCTION

The Canadian Corporate Counsel Association (CCCA) and Mondaq are pleased to present the results of our second, annual Canadian In-House Counsel Survey. Based on over 670 responses, from across the country and across all job levels, this report provides Canadian in-house counsel and the legal profession with unrivalled insight into the key questions and issues that are impacting individual counsel and legal departments today. Designed in partnership with an advisory board composed of eminent in-house counsel, this report provides up-to-date and robust analysis of current hot button issues and future outlooks.

We would like to thank the Canadian in-house community for their fantastic support of our survey, which has already established itself as the definitive annual report into the Canadian in-house profession, as well as our advisory board members for their sage counsel. Thank you also to our survey report sponsor, Ricoh Canada, for enabling us to further amplify the survey findings and analysis.

About the CCCA

The CCCA is the leader and voice for Canadian in-house counsel. Founded in 1988 as a forum of the Canadian Bar Association, we represent over 5000 in-house counsel from every province and territory, and sector and industry, making us the most inclusive and representative professional association for in-house counsel in Canada. Our members are lawyers working for public and private companies, not-for-profits, associations, government and regulatory boards, Crown corporations, municipalities, hospitals, postsecondary institutions and school boards.

About Mondaq

Mondaq is a leading global provider of AI-enabled content marketing, analytics and data solutions for professional services firms and helps its over 20 million readers worldwide to find answers to legal, tax and compliance questions. Mondaq has over 2 million readers in Canada, including the majority of Canadian in-house counsel and executives from thousands of Canadian organizations.

It is our hope that you will find this report useful in helping you to make informed decisions about your and your department’s priorities, now and in the future.

Alexandra Chyczij

Executive Director

Canadian Corporate Counsel Association

Tim Harty

Chief Executive Officer

Mondaq

METHODOLOGY

In September 2022, the CCCA and Mondaq launched it’s second, annual Canadian In-house Counsel Survey. The survey’s objective is to provide unrivalled insight into Canadian in-house counsel, by being the country’s most comprehensive and most representative survey into the state of in-house legal departments. 678 respondents completed an online survey between September and November 2022, which represents 47% growth in response over the 2021 survey.

The survey included 38 questions covering organization and legal department details, budgets and investment, outsourcing, technology, innovation, as well as respondents’ priorities, challenges and other people-focused questions. This was followed by a voluntary self-identification section, which over 400 respondents went on to complete.

SURVEY

RESPONDANTS

462

SURVEY

RESPONDANTS

678

2022

2021

To provide rigorous oversight and authority, the survey was designed in partnership with our survey Advisory Board, which includes eminent Canadian in-house counsel.

Advisory Board

Fernando Garcia

Senior Vice President, Legal and General Counsel

Cargojet

Steve Smyth, CIC.C

Vice President, Corporate Development and General Counsel

Trotter & Morton

Margot Spence, CIC.C

Executive Director, Legal

Destination Canada

PARTICIPANT PROFILE

The responses have provided the representative view the survey is seeking, with 25% of participants providing a view from the top (CLOs/GCs) and excellent representation throughout legal departments with a significant number of responses from Associate GCs (7%), Senior Counsel (21%), Counsel (34%) and Director of Legal Services/Legal Managers (8%). The survey saw excellent response-levels from public companies (28%) and private companies (24%), representing all the key industry sectors and organization sizes, as well as from government organizations (34%) and not-for profits (9%). More survey respondent specifics are to be found in the Participant Profile charts to the right.

Location

Ontario

British Columbia

Alberta

Quebec

Manitoba

Saskatchewan

Nova Scotia

Other

0%

10%

20%

30%

40%

Job Role

Legal Counsel

CLO/GC

Senior Counsel

Director/Manager of Legal

Associate/Assistant GC

Other

0%

10%

20%

30%

40%

Organization Type

Government

Public Company

Private Company

Not-for-profit/Charity

Other

0%

10%

20%

30%

40%

1,001-5,000

10,000+

51-200

5001-10,000

201-500

1-50

501-1,000

0%

10%

20%

30%

Organization Size by Employees

EXECUTIVE SUMMARY

Coming out of the global Covid-19 pandemic and against the backdrop of a major European war contributing to the global energy and inflationary crisis, the CCCA & Mondaq Canadian In-House Counsel Survey seeks to shine a light on the state of Canada’s in-house legal profession. The extensive questionnaire and high survey participation, provides unrivalled insight into legal departments’ spending, staffing, investment, insourcing and outsourcing focus; reveals the biggest challenges and priorities across all in-house job levels; and provides insights into what makes a great in-house lawyer in 2023.

The aftermath of Covid-19 continues to present challenges to Canadian in-house legal departments, most notably in terms of new working arrangements, with 87% of legal departments working on a hybrid basis and 27% of these not mandating staff to spend any time in the office. The profession continues to see high levels of work-related stress and anxiety levels, with 46% of respondents seeing an increase in work-related stress and anxiety levels in the last year, compared to just 13% seeing a decline. Counter-intuitively, based on the issues reported, there does not yet appear to be the required focus on employee wellbeing and staff retention solutions.

46%

of respondents seeing an increase in work-related stress and anxiety levels in the last year

As per the 2021 survey results, increased levels of in-house accountability combined with the heightened demand for

in-house services and the consequent increase in workload, there is the potential for significant staff burnout and fallout. There remains a clear call to action for legal department leaders and managers to put in place more programs which support employee wellbeing. Moreover, while there is a small improvement over 2021, with 35% of legal departments not yet deeming ED&I a priority, there remains an opportunity for legal departments to further prioritize ED&I initiatives.

There remains a clear call to action for legal department leaders and managers to put in place more programs which support employee wellbeing

Based on the reported uptick in demand for in-house legal services, there is a more pronounced move towards an increase in legal department budgets and headcount as well as a continued focus on legal technology investment. It appears that more of the demand is expected to be met internally, through additional investment in people and technology, as one of the distinct year-on-year shifts the survey shows is that more in-house departments are expecting to outsource less work to outside counsel and, conversely, considerably fewer departments are expecting to outsource more work to outside counsel. From the buy-side there is an expectation from in-house teams that outside counsel are both experts in the law and experts on their businesses and industry sectors, and there is heightened importance placed on the level of client service and value of money when buying outside legal services.

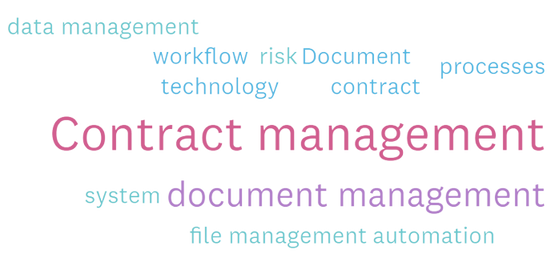

Common top priorities across all inside counsel job roles are contract management, a focus on supporting the business and business growth, strategy and, unsurprisingly, providing legal services Beyond the oft reported increase in work volumes, the biggest legal challenges facing Canadian in-house counsel are more distributed today, with significant challenges including risk and compliance, litigation, privacy and staff retention.

In-house counsel are increasingly carrying accountability beyond their legal responsibilities, including compliance, ethics, investigations and more. ESG is rapidly becoming a key responsibility for CLOs/GCs, with nearly one in five now also responsible for ESG (up from 11% in 2021). While much additional responsibility is centred on CLOs/CGs, counsel and senior counsel frequently pick up additional responsibilities too.

It is evident that the best in-house lawyers today require so much more than legal skills, with the most common skills mentioned for an effective in-house lawyer in 2023 being communication skills, followed by understanding the business and flexibility and adaptability. It is likely that it’s these skills beyond pure legal that are helping employees move from the legal department to non-legal roles outside of it, with one in five respondents seeing an increase in the number of in-house counsel moving into non-legal business roles.

BUDGETS & INVESTMENT PRIORITIES

While five in 10 legal departments are expecting their budgets to stay flat in the next year, 40% expect in-house budgets to grow (up from 33% in 2021) and just 11% (down from 14% in 2021) are expecting a decline in budgets. Budget growth is expected across all types of organizations, from public companies (42% expect budget growth) to private companies (46% expect growth), government organizations (38% expect growth) and not-for-profits (30% expect growth).

Increasing responsibilities and demands on in-house counsel appear to be driving budget growth. The top six areas of increased in-house demand are around data privacy (50% expect increase in activity), risk and compliance (50% expect increase), contract management (44% expect increase), providing business strategy and advice (35% expect increase), dispute resolution and litigation (32% expect increase) and supporting operational delivery (32% expect increase), . Building on the 2021 direction of travel, it’s clear that organizations are increasingly looking to their legal departments to manage risk – across privacy and other areas of compliance – and to act as a business partner to help them navigate through choppy waters.

Expected Increase in In-House Demand

50%

DATA PRIVACY

50%

RISK & COMPLIANCE

44%

CONTRACT MANAGEMENT

Business Strategy

& Advice

35%

DISPUTE RESOLUTION

& LITIGATION

32%

supporting operational delivery

32%

The biggest beneficiary of the additional spend is legal department staffing, with 47% of respondents expecting to spend more on people (compared with 5% who will spend less) driven by additional hiring (35% of respondents anticipate headcount growth versus just one in 40 a decline). This is highest in both public and private companies, half of which are intending to spend more on in-house staffing and 40% are expecting headcount growth. Thirty-two per cent of government legal departments are expecting to expand headcount in the coming year. The signs are that the battle for legal talent within the Canadian market is set to continue, exacerbated by the additional pressure that remote/hybrid working is placing on staff engagement and retention.

Expected size of the total in-house legal department budget over the next year:

50%

40%

30%

20%

10%

0%

The same

Slightly more

Slightly less

Significantly more

Significantly less

The next biggest budget beneficiary is technology, with 41% of respondents expecting to spend more (versus just 2% spending less). This number is highest in public companies, with 54% expecting to invest more, and lowest in private companies, although 38% are nevertheless expecting to spend more on technology (compared with just 3% spending less).

Spend on outside counsel is the one line of expenditure that appears to be most challenged in the coming year. While 33% intend to spend more on outside counsel (down from 35% in 2021), 20% are expecting a reduction in spend, an increase from the 17% who expected a reduction in outside counsel spend 2021. This is most pronounced in public companies, with 30% expecting to spend less on outside counsel and 25% more. There does not appear, though, to be a shift of expenditure from outside counsel to alternative legal services providers (ALSPs), with only 14% of respondents making use of ALSPs (in line with 2021). The impact of ALSP spend on overall budgets is minimal, with 13% of respondents seeing more ALSP spend compared to 7% less.

So, while demand for in-house services is increasing significantly across many areas, it’s apparent that much of this demand will be met internally through additional investment in people and technology, and that there’ll likely be some challenge on external counsel spend, with one in five departments expecting to spend less in the coming year.

OUTSOURCING

Outside Counsel

One of the distinct year-on-year shifts the survey shows is that more in-house departments are expecting to outsource less work to outside counsel (22% this year vs. 19% in 2021) and considerably fewer legal departments are expecting to outsource more work to outside counsel (22% this year vs. 30% in 2021). This is most pronounced in public companies, with 30% expecting to send less work to outside counsel compared to 25% expecting to send more work to outside counsel. The data suggests that law firms will need to work even harder to retain existing clients and fees, as well as to gain new clients and fees.

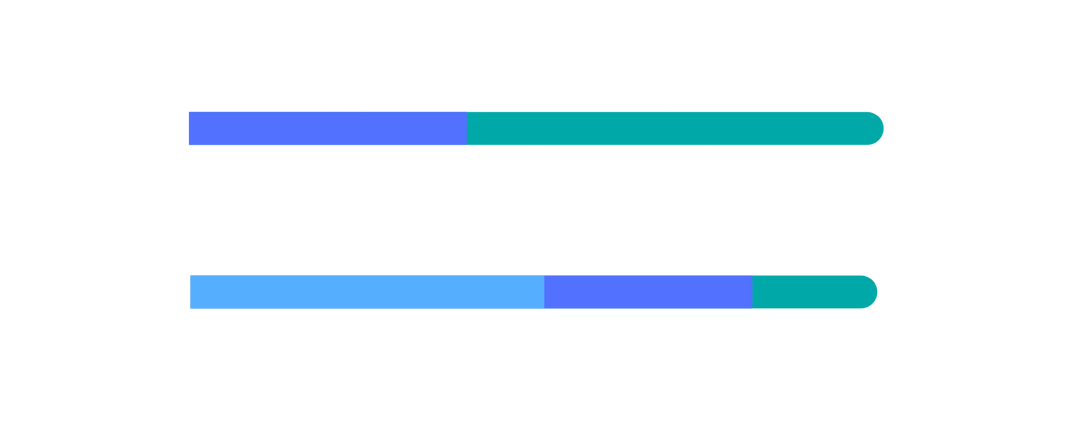

When choosing to instruct outside counsel, the top four considerations are legal expertise (99% consider important or very important), practical advice (96%, up from 91% in 2021), client service (94%, up from 89% in 2021) and understanding the client’s business (93%, up from 86% in 2021). A key learning from this year’s survey is that significantly more inside counsel deem client service very important (62% this year vs. 55% in 2021), value for money very important (55% vs. 50% in 2021) and legal expertise very important (80% vs. 74% in 2021). This suggests outside counsel will be required to provide better technical services while providing improved levels of client service and better value for money. One could reasonably surmise that law firms will be putting in more effort, perhaps for less reward, for their clients over the next 12 months.

From the data it is evident that, in addition to legal expertise, outside counsel need to understand their clients’ organisation and business requirements. In line with this, 23% (up from 21% in 2021) are also seeking external expertise on industry perspective and intelligence, another way in which outside counsel can bolster their offering. It is also apparent that law firm investment in technology and innovation is also becoming more important in buy-side decision-making, with 24% of legal departments now deeming this an important buying factor, up by half over 2021, as is the firm’s brand and reputation. The importance of outside counsel Diversity & Inclusion in buying decisions remains steady at 30%.

Additionally, with the number of respondents deeming existing senior-level outside counsel relationships important or very important dropping to 44% (from 49% in 2021), this could be seen as encouraging to law firms who are looking to win new business and perhaps, conversely, as a warning to firms and partners who place too much emphasis on managing existing relationships over other key drivers of legal services purchasing.

Work Areas Most Often Outsourced

73%

Seeking expert advice in

a new area

67%

Transactions and activities

where legal departments

want external counsel

assurance and opinions

64%

Transactional activities

where legal departments

don’t have internal

capacity

Unsurprisingly, the three types of work that are most often outsourced to outside counsel are centred around areas where existing in-house capabilities don’t exist or need to be supplemented: seeking expert advice in a new area (73% likely to outsource), transactions and activities where legal departments want external counsel assurance and opinions (67%), and transactional activities where legal departments don’t have internal capacity (64%). These results are in line with those of 2021.

Key Learnings from this Year’s Survey

Significantly more inside counsel deem the below to be VERY important

2022

2021

Client service

Value for money

Legal expertise

0%

20%

40%

60%

80%

In addition to legal expertise, outside counsel need to understand their clients’ organization and business requirements.

OUTSOURCING CONTINUED

How Important are the Following Factors when Selecting Outside Counsel?

Other Outsourcing

Law firms continue to dominate the market for outsourced legal services. Just 14% of in-house teams use Alternative Legal Service Providers (ALSPs), increasing to 16% of private companies and 21% of public companies, while reducing to 9% in government organisations. Spend on ALSPs is expected to see slightly more growth in the next 12 months than the prior year, with 13% of respondents spending more compared to 7% less.

E-discovery is outsourced by 12% of in-house legal departments, a 20% increase on last year. This increases to 15% in public companies. Translation services are also used by 12% of in-house teams, increasing to one in five in public companies, where there is significantly more demand.

Percentage of Legal Departments Using:

14%

ALSPs

12%

E-discovery

12%

Translation services

When Outsourcing

96%

Outsource within

Canada

27%

Outsource outside of

Canada

INNOVATION & TECHNOLOGY

Innovation

Innovation in legal and risk management is a priority for 54% of legal departments (up from 52% in 2021). While some in-house counsel are blunt about the lack of innovation (“We don’t innovate.” Legal Counsel, Private Company), the majority of respondents take innovation seriously. Legal and risk management innovation is highest in public companies, where 6 in 10 legal departments in public companies are innovating as a priority, followed by private companies at 56% and government organizations at 50%.

The most common areas of innovation, as in 2021, are document management and contract management, followed by legal workflow innovation. Much of this innovation continues to be fueled by the acceleration of digital transformation (“We’re moving 100% to digital.” Senior Counsel, Public Company) triggered by the Covid-19 pandemic, as well as cost and risk management.

The Single Biggest Area of Innovation in the Legal Department is:

Technology

There is a marked increase in the number of law departments treating investment in legal department technology as a priority – 45% of organizations are prioritizing investment in legal department technology (up from 39% in 2021). This is highest in public companies at 55% (a big jump from last year), followed by government organizations at 50% and private companies at 41%.

The prioritization of technology investment is visible in spending plans, with 41% of respondents expecting to spend more on technology in the next year (compared to just 2% spending less). This number is highest in public companies with 54% expecting to invest more and lowest in private companies, although 38% are nevertheless expecting to spend more on technology (compared with just 3% spending less).

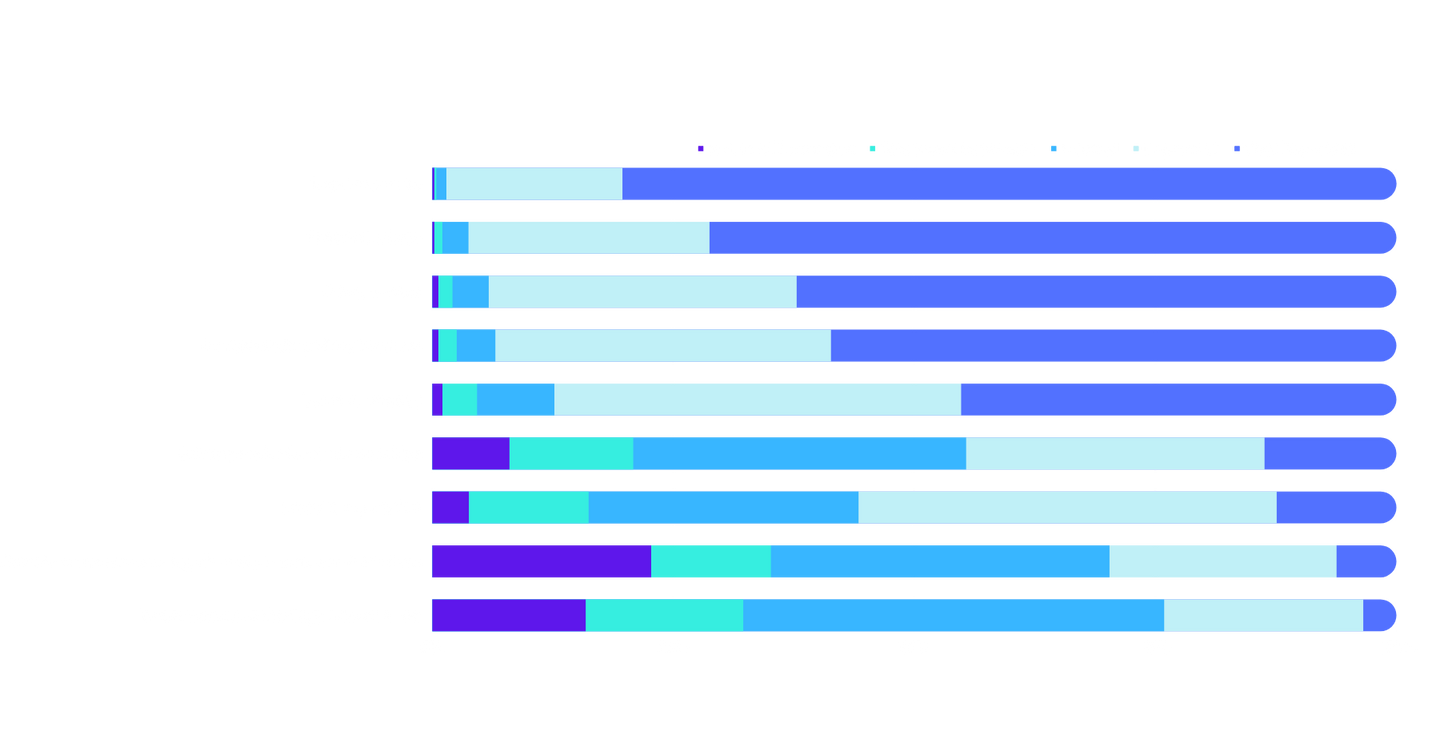

Growth in technology investment is expected to come from document management, data privacy management and contract lifecycle management, with a vast majority of legal departments investing in these areas and most growth in investment expected from these areas. While spending on e-signature technology seems to have peaked in the past year, it appears that remote/hybrid working arrangements and digital transformation continue to be the drivers behind much of this technology investment. With 87% of Canadian law departments operating a hybrid location model, of which 27% do not make any office attendance mandatory, spend on digital transformation and technology is expected to continue at pace.

Number of organizations expecting to invest more in these technologies

38%

Document Management

38%

Data privacy management

22%

Contract lifecycle management

WORKFLOW MANAGEMENT

20%

Finally, cost (even more so than in 2021) and the lack of integration with other technology (even more so than in 2021) remain the two biggest barriers to the adoption of legal department technology. With cost as a barrier to technology adoption increasing to nearly 80% and lack of integration increasing to nearly 60%, it is evident that solution providers need to do more to address these issues.

There is a marked increase in the number of law departments treating investment in legal department technology as a priority

PRIORITIES

& CHALLENGES

The 2022/23 survey responses show a big shift in focus away from the Covid-19 pandemic. Whereas feedback was heavily focused on the pandemic and its various impacts in 2021, there is barely a mention of the words “covid” and “pandemic” in the over 1,200 open-ended survey responses to questions around the biggest priorities and biggest challenges. It is likely that shift is based, firstly, on the significant reduction of the impact of the pandemic and, secondly, as the result of any lingering impacts of the pandemic being treated as part of business-as-usual working.

Top Priorities

When asked about their single biggest business priority, there is not a primary anchor point in the form of the Covid-19 pandemic as there was in 2021. Looking at priorities across all job levels, with a specific focus on three major job-groups (namely, CLOs/GCs, counsel and senior counsel and Legal Directors/Managers), there are some clear findings.

Common top priorities across all the job roles are contract management, a focus on supporting the business and business growth, strategy and, unsurprisingly, providing legal services. CLOs/GCs are more often to call out data privacy and transactional work as a priority. Counsel, senior counsel and Legal Directors/Managers have a greater focus on legal business operations, processes and efficiency as a top priority.

There is barely a mention of the words “covid” and “pandemic” in the over 1,200 open-ended survey responses to questions around biggest priorities and challenges

Given that 65% of legal departments state ED&I is a priority, it’s perhaps surprising that there are very few references to ED&I at all. Also, given the continued high levels of work-related anxiety and stress across all levels of in-house roles, much of it related to workload, as well as the employee retention challenges called out by survey respondents, it is counter-intuitive that employee wellbeing and retention does not feature as a top priority (at the very least for in-house counsel leadership).

Biggest Challenges

When asked about the single biggest legal challenge respondents expect to face in the coming year, the shift away from challenges presented by the Covid-19 pandemic is stark and perhaps to be expected.

Increasing demand and volume of work is prevalent as this year’s biggest legal challenge (even more pronounced for counsel and senior counsel), which is in part a consequence of the increasing amount of work being taken on by legal departments.

The greatest legal challenge the board of my organization expects to face in the coming year is:

The remaining biggest legal challenges facing Canadian in-house counsel are more distributed this year, with significant challenges including risk and compliance, litigation, privacy and staff retention. CLOs/GCs are more likely than other job roles to state litigation as their single biggest challenge.

As with in-house teams, the biggest legal challenge boards are expected to face no longer relate to Covid-19, but instead are spread across a wide range of challenges. The challenges can be grouped into regulatory & compliance management (including privacy, ESG and the environment), financial, economic and recession, acquisitions and litigation and, finally, people matters including employee retention. Boards clearly have a lot of legal challenges to contend with and the read-across is that the impact of legal departments and legal leadership on businesses will continue to increase.

EQUALITY, DIVERSITY

& INCLUSION

Equality, diversity and inclusion (ED&I) continues to be a focus for organizations; however, the survey indicates that while the number of respondents reporting that ED&I is not a priority for their organizations has reduced since 2021, there is much more to be done in legal departments, particularly those with up fewer than 30 staff.

Survey Response Diversity Data Based on Voluntary Self Identification Questions:

Respondents were asked whether ED&I was a priority in their own legal departments. Of the nearly 600 respondents who answered, 35% stated that ED&I is not a priority in their legal departments. While the number is lower than the 38% reported in 2021, there is still considerable room for improvement. The lack of priority on ED&I was reported more widely by more senior members of the legal department (37% of CLOs and GCs stated that ED&I is not a priority, down from 39% in 2021) than less senior members of the department (34% stated that ED&I is not a priority, down from 38% in 2021). This is concerning given that nearly 4 out of 10 of those at the top table, who are most likely to have control and responsibility over the composition of the legal department, are reporting that ED&I is not a priority. There are signs that organisations are trying to innovate in the area, with some respondents naming ED&I as the area of most innovation in their legal departments.

Discrepancies in results were found based on location. For instance, more respondents in Ontario (71%) felt that ED&I was a priority for their departments when compared to those in other provinces, with Alberta at 68%, Quebec at 66%, British Columbia at 65% and Manitoba the lowest at 48%. Sentiment seems to be closely tied to the type of organisation and the size of the legal department. The highest rate of negative response was in private companies, with 50% noting that ED&I was not a priority, compared to 30% in both government and the not-for-profit sector, and 25% in public companies.

Significant discrepancies can also be found when an analysis is done of the size of the legal department. Here we found that the vast majority (87%) of legal departments with more than 30 staff stated that ED&I was a priority, whereas only 61% of departments with 5 to 30 staff felt it was a priority. A better understanding is needed of the obstacles and barriers faced by small- to mid-sized legal departments when it comes to prioritising ED&I.

Black

2%

South Asian

4%

Race/ Ethnicity of Respondants

Chinese

5%

Caucasian

80%

In terms of diversity data, the survey’s voluntary self-identification questions, which were completed by over 400 respondents, show that while the in-house community is gender diverse (60% identifying as female and 40% identifying as male) and age diverse (51% between the ages of 25 and 44, 30% between 45 and 54, and 18% 55 years and older), it is much less diverse from the perspective of race/ethnicity (80% Caucasian).

PEOPLE & TALENT

Given the high level of survey participation (678 respondents) we are able to examine a significant number of responses across all job levels, helping us to deliver a view from the top as well as from middle- and junior-tier in-house counsel roles.

This year’s survey included a new section on remote/hybrid working, which shows some stark market outcomes. The survey indicates that 87% of Canadian in-house legal departments are operating a hybrid location model (90% of public companies, 80% of private companies and 88% of government organizations), with 27% of those mandating no days at all in the office. Fourteen percent of law departments mandate one day a week in the office, 25% mandate two days and 27% mandate three days. Less than one in 20 organizations mandate four or five days a week in the office. The data shows the larger the organization, the more likely to be hybrid and the more likely to mandate fewer days in the office. Just one in three law departments has 100% of its staff in the office two or more days a week (decreasing to one in four for organizations with over 5,000 employees). In terms of challenges created by hybrid working, employee engagement is rated as the most difficult area, followed by employee retention.

Remote/Hybrid Working Arrangements:

87%

27%

Using hybrid location model

No mandated office days

It is evident that in-house personnel are carrying significant accountability beyond their legal responsibilities, with over 45% of in-house counsel also responsible for compliance, while one in four is responsible for investigations and the same ratio is responsible for ethics. Twenty per cent of in-house counsel are now responsible for government relations (up from 17% in 2021). While just 11% of in-house counsel are also responsible for ESG, this number has increased by a third since 2021. Finally, in public companies, investor relations are also a frequent additional responsibility. Much of this additional accountability is centred on CLOs/GCs, with 58% responsible for compliance, 44% for ethics and 33% for investigations. ESG is rapidly becoming a key responsibility for CLOs/GCs, with nearly one in five CLOs/GCs now also responsible for ESG (up from 11% in 2021). Senior counsel and legal counsel frequently pick up additional accountability too.

More responsibility, more flexibility and more stress

In-House Personnel Accountability Beyond Legal

45%

of in-house counsel are also responsible for compliance

27%

are responsible for ethics

25%

are responsible for investigations

20%

are responsible for government relations

11%

are responsible for ESG

PEOPLE & TALENT CONTINUED

Given the level of responsibility beyond the delivery of legal services, combined with post-pandemic economic challenges, it is no surprise that stress and anxiety levels are running high across in-house legal departments. In 2021, an alarming 71% of respondents reported an increase in work-related stress and anxiety in the last year; while a lower 46% reported an increase this year, it’s an increase on a highly stressed base, and what’s more, just 13% said their work-related stress and anxiety decreased since 2021.

This year the increased level of work-related stress and anxiety is highest in CLOs/GCs at 49% and Director of Legal Services/Legal Manager at 58%. The increase is highest in public companies (53%) and very similar across those who identify as female (47%) and male (46%). In the 2022/23 survey, there are again numerous mentions of increasing workload and burnout in response to the biggest challenge faced by respondents. Organizations and their legal departments are clearly continuing to store up major employee wellbeing issues and more action needs to be taken to assist employee wellbeing and mental health.

It is evident that in-house lawyers require so much more than legal skills, with the most common three skills mentioned for an effective in-house lawyer today being communication, followed by understanding the business and flexibility/adaptability. Communication is now the number one skill required by

in-house counsel, perhaps indicative of an ever more complex and stressed work environment.

It could be these skills beyond pure legal are facilitating in-house counsel employees to move from the legal department to non-legal roles outside of it, with one in five respondents (in line with 2021) seeing an increase in the number of in-house counsel moving into non-legal business roles. The most common non-legal roles accepted are HR, risk and compliance and management roles. ESG and Strategy roles were also frequently mentioned.

So, while work-related stress and anxiety is undoubtedly a huge issue facing the

in-house profession, there is significant opportunity for in-house counsel to develop their roles/careers both within legal departments as well as outside of law departments in non-legal roles.

Non-Legal Roles Most Likely for In-House Counsel to Move Into:

Reported Increase in Work-Related Stress and Anxiety:

While the increase is lower in 2022, it is important to note the increase is on an already highly stressed base

2022

2021

0%

25%

50%

75%

49%

of CLOs/CGs reported increased levels of stress and anxiety

58%

of director of legal services/legal manager reported increased levels

1 in 5

respondents seeing an increase in in-house counsel moving into non-legal business roles

CCCA | Mondaq

2023 Canadian In-House Counsel Report

Unparalleled Insights into Canada's In-House Profession from CCCA | Mondaq

Sponsored by

Please consider the environment before printing